Happy Thanksgiving!

From our family to yours. Happy Thanksgiving from your friends at Capstone CPA Group!

From our family to yours. Happy Thanksgiving from your friends at Capstone CPA Group!

A federal judge on Tuesday blocked a Department of Labor administrative ruling. Commonly known as the new mandatory overtime pay law, the Department of Labor in conjunction with the Obama administration changed the rules relating to overtime pay for certain workers making less than $47,500. This rule was set to take effect on December 1, 2016. However, this injunction and case will determine whether the change to the overtime rules is enforceable by the Department of Labor.

The federal judge presiding over this case issued an injunction, of the new policy. This injunction stops the Department of Labor from being able to enforce this new law (temporarily), while they hash out whether the Department of Labor has the authority to classify workers by annual pay. As more information is available, we will try to provide you with updates.

For more information about the injunction and what it may mean for your business, reach out to us and check out this article .

Later this month we will cover the new overtime rules and help you determine whether you would be covered by these changes, and some measures to take to make sure you can comply with these changes (if they are to take effect).

We hope you enjoyed our initial installment last week, where we covered the likely changes associated with the Trump tax plan. Specifically, we covered how the Trump tax plan may impact individuals. In the second part of our examination of the Trump tax plan we reviewed proposed changes in tax policy for business taxes.

Some of the largest cuts in the Trump tax plan are reserved for business taxes.

The top corporate tax rate would fall from 35% to 15%. This lowering of the corporate tax structure would make corporate taxes much more attractive under certain circumstances by reducing the effect of double-taxation of corporate profits. This is especially true when you consider that the current capital gains and dividends rates are much lower than historical rates.

In a major shift of tax policy, the owners of pass-through entities, such as sole proprietorships, DBA’s, partnerships, and S-corporations, could elect to be taxed at a flat rate of 15% on their business income rather than “regular” individual income tax rates. This change could make a big difference. We will use one example. Let’s say you have the option to go to your employer and ask to be treated as a subcontractor going forward. If your normal “highest” tax rate is 33%, if you elected to pay the flat 15% rate, you might be able to save up to 18% in federal taxes by changing the structure of your income. While it is too soon to know if this change will go through, it will be important to keep an eye on this tax change alone!

The Trump tax plan also contains a strategy to decrease the incentive for a US company to “move” its tax residence overseas. Currently a 35% tax rate is applied to companies that wish to repatriate cash held overseas. The Trump tax plan would impose a one-time tax of 10% on the repatriation of cash to the US. This shift in tax policy should increase cash available for reinvestment and dividends in the US.

Businesses engaged in manufacturing could also elect to expense investment in equipment rather than depreciating the cost over time. If this election is made, the business would not be allowed to deduct interest expenses on their business return.

Available documents describing the Trump tax plan also imply many business credits would be repealed. Specifically, the research and development credit would be retained and the credit for employer-provided child and dependent care may be expanded. Other credits may be on the table. But, the language is too vague at this point to help provide further guidance one way or the other.

Thank you for allowing us to nerd out on tax policy. Overall we see some benefits and detractions relating to the proposed changes. So, if you would like more information about how these changes may affect you and your business, feel free to reach out to us by email at [email protected] or 616-822-2981.

With the election in our rear view mirror, many people are wondering what financial agenda the Trump team will implement. We are also interested in the total financial package President-Elect Trump will propose, outlines of his tax agenda are already fairly well documented.

President-Elect Donald Trump has proposed the largest tax cuts since Ronald Reagan. The last time there was unified party control in Washington our gift was the Affordable Care Act. Not only did Donald Trump win the presidency, but the Republicans retained control of the House and the Senate. In spite of Trump’s very public battles with ingrained Republicans, Trump’s tax plan is similar in many ways to the ideas of the rest of the Republican Party. That means his tax plan could very well happen by the summer of 2017. We offer to you a summary of the most likely outcomes of a Trump tax reform.

Trump’s plan would reduce the number of tax brackets from seven (currently) to three with rates of 12%, 25%, and 33%. The top tax rate would drop from 39.6 % to 33%. Also, the Net Investment Income Tax (part of the ACA) of 3.8% on high-income taxpayers would be eliminated. The alternative minimum tax would also be gone, and to use the president’s words, it’s gonna be huge. Preferential tax treatment of capital gains and dividends would be retained. While we cannot find specific support (since many are split on whether to call it a penalty or tax) we are only to assume that if the ACA is eliminated so to would the responsible party penalty (non-insured penalty).

The Trump tax 2017, would eliminate the current federal estate, gift, and generation-skipping transfer taxes. Instead, the Trump tax plan would place a special capital gains tax, upon death, for tax payers who have more than $5 million for single filers and $10 million for married couples. We are hoping for more information about this tax to become available in the coming months.

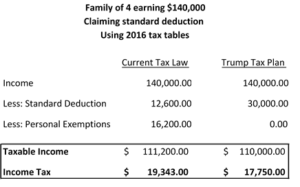

The standard deduction would be increased from $6,300 to $15,000 for single filers and from $12,600 to $30,000 for joint filers. But, this plan would eliminate personal exemptions. Certain taxpayers may still be able to itemize, but specific details are unclear at this point. The head of household filing status (available to single taxpayers with a qualifying child) would be eliminated. The loss of personal exemptions and the head of household filing status would cause many large families and single parents to face tax increases. President- Elect Trump has also stated that his plan would include some sort of preferential treatment for child care expenses. However, at this time it is unclear as to the exact amounts, caps and limitations of such a tax deduct or tax credit.

This is the first part of a two-part examination of the 2017 Trump tax plan. Look for our next installment next week, that examines how changes may affect businesses. As always, feel free to reach out to us as the tax landscape changes. [email protected] or 616-822-2981.

We have included a simple table to show how the Trump Individual tax plan may affect an average American household. Please see the Individual Trump tax table

Also, check out our post- Trump Individual tax plan. This post highlights some of the proposed tax reforms that are likely to be adopted in 2017. While it is still to early to know what portions of the total plan will be adopted. We feel that given the current political environment, these reforms have a high likelihood of happening. Especially given the fact that both parties and the general public have been asking for real tax reform in the last few years.

This is the first part of a two-part examination of the Trump tax plan. Look for our next installment next week, that examines how changes may affect businesses. As always, feel free to reach out to us as the tax landscape changes. [email protected] or 616-822-2981.

Cannot Display Feed

Pls check if the Facebook page exists or not.